Related Stories

Union Bank of the Philippines (UnionBank) is set to become the country's first universal bank to offer virtual asset exchange services through its mobile banking application.

This marks another important milestone in the bank's efforts to future-proof by creating customer-centric solutions powered by technology and innovation.

The newly unveiled feature is part of UnionBank's "Tech-Up Pilipinas" patronage, which aims to promote digital literacy among Filipinos, consistent with its goal of enabling inclusive prosperity in the country.

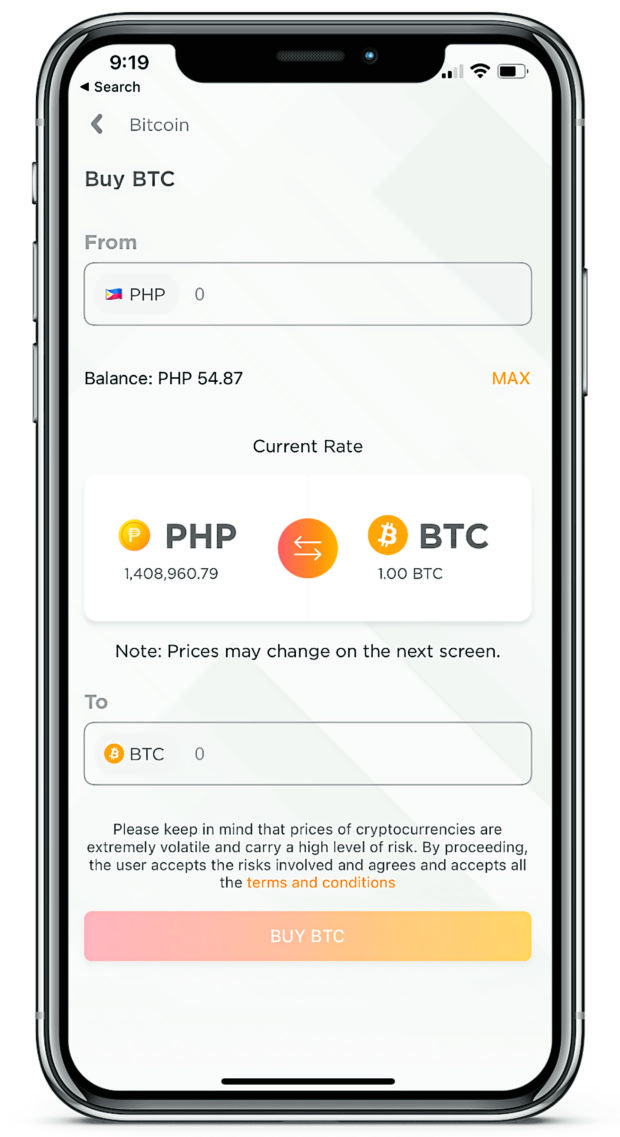

UnionBank Mobile Banking - New Bitcoin Feature

With this new feature, UnionBank customers can now buy and sell Bitcoin (BTC) directly from their mobile banking app without the need for a third-party virtual asset wallet. This eliminates the need to use multiple apps and makes buying and selling BTC easier and more convenient.

The new functionality will be rolled out to randomly selected UnionBank customers who will be able to see the Virtual Asset functionality in their app. The launch complies with the Bangkok Sentral ng Pilipinas (BSP) regulations on virtual asset services.

A wider deployment is planned soon. Blockchain is an essential part of UnionBank's future strategy. The bank has carefully and conscientiously studied the possible uses of new technology and its offshoots, such as cryptocurrencies.

UnionBank Embraces Blockchain

According to Cathy Casas, Head of Blockchain Center of Excellence at UnionBank, “Blockchain is a technology that we believe will be key to the future of banking.” At the same time, we also recognize that cryptocurrency is one of the services that many customers are already looking for, especially those in the younger generation. Demand has increased during the pandemic.

Embracing blockchain as part of UnionBank's strategy for the future aligns with its efforts to expand its presence in the Metaverse (roughly a collection of new digital spaces). UnionBank first entered this new digital space through its partnership with local NFT game Ark of Dreams in April.

Metaverse Center of Excellence Launched

The Bank hopes to launch the country's first Metaverse Center of Excellence in the coming months.

"By launching this new feature, we are hitting two birds with one stone: future-proofing the bank and meeting the needs of customers using cryptocurrencies," said Henry Aguda, Senior Executive Vice President Chief Technology and Operations Officer and Chief Transformation Officer. "This is one of the things we are working on as we open our path to the metaverse."

Post a Comment

Hey... say something!